HOW SWEET IT IS...

- terryswails1

- Mar 15, 2022

- 3 min read

There's nothing like starting a new week with sunshine and mild temperatures. Highs Monday reached the low 60s in the south and were well into the upper 50s elsewhere. I even had the pleasure of watching a couple robins taking in the fine weather on my window sill. Overall, readings were above normal by about 12-15 degrees and the warmth was widespread across the central Midwest. Here's Monday's temperature departures.

Looking at the general trends in the upper air pattern it appears we are setting up for an extended period of warmer than normal temperatures to close out the month of March. Here's the long range outlooks from the Climate Prediction Center.

The 6-10 day outlook March 19-23rd.

The 8-14 day outlook March 21-27th

Here's the experimental week 3 and 4 outlook. The odds are pretty good that the mild temperatures will continue into the first week of April. That does not mean there won't be some cold days mixed in, just that overall warmth will outweigh the cold when all is said, done, and averaged.

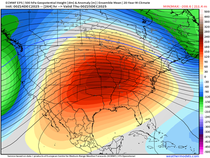

Here's the mean 7 day 500mb jet stream heights for March 21st to March 28th. The overall flow has a SW component which is good for warmth. It should also portend wetter weather in time assuming things set up as indicated.

Speaking of precipitation, the next chance arrives Thursday but there is extremely poor agreement in regards to where and how much. The GFS has been staunch on developing a strong system that brings over an inch of liquid equivalent to the NW half of my area. Not only is it wet, it's cold enough Friday to bring some wet snow. Here's what the GFS shows for both precipitation and snow totals.

GFS rain

GFS snow

The EURO and GEM are in a camp of their own showing less phasing indicating a system that's further southeast. That keeps the bulk of the rain (perhaps a little snow) down in Missouri and central Illinois, (the preferred path of storms the past couple of months). The EURO indicates this for precipitation and snow totals, far different than the GFS.

EURO precipitation totals

EURO snow totals.

The GEM is even a bit further southeast on its precipitation field keeping the majority of it southeast of the Quad Cites with no snow impacts within my area.

The GEM precipitation totals

The GEM snowfall totals

Frankly, when you look at the statistical means of a traditional La Nina winter, you can see how the Ohio Valley and areas just southeast of my area are favored for wetter weather than areas northwest.

Here's another perspective. True to form, this is how our winter has evolved as it gradually grinds to an end, Based on the statistical odds and recent trends, I believe the GFS is over amplified, too far north, too wet, and far too snowy.

We may see some showers later Thursday and Thursday night but I think the southeast is where most of the rain will occur. HWY 34 south looks to have the best chances of 1/4 inch or greater. I just can't buy what the GFS is selling. Hopefully we can tighten the spread later Tuesday. Something has to give.

Assuming I'm reading the cards correct, we will see a cool down Friday with clouds and showers dropping highs close to 50, especially over the southeast. However, the passage of the system Saturday opens the door for more sunshine over the weekend initiating another warm-up that drives highs back into the 60s if not Saturday, most certainly Sunday. Here's the EURO meteogram for the Quad Cities through Tuesday March 22nd.

Meantime, Tuesday looks to be another outstanding mid-March day with sunshine and highs of 55 to 60 areawide. Put it on the board! Have a sensational day and roll weather...TS

PLEASE CONSIDER SUPPORTING TSWAILS...

Hi everybody, I'm asking that those of you who find value in the site to consider a $12 dollar voluntary subscription covering operating expenses and the time and effort I put into the site. My $12 dollar asking fee is the cost of a pizza or a dozen donuts. Those are gone in a day, TSwails.com is here for you all year long. It's a heck of a value and all I'm asking is that if you enjoy the site and see value in it, that you please consider a voluntary subscription. I'm asking $12.00 dollars a year. That's $1 dollar a month or 3 cents a blog. Thank you for your support and consideration. Terry

Comments